Many buyers are waiting on the sidelines for mortgage rates to drop in 2023. The question is, will that happen? If it does, when will it happen and how much will mortgage rates drop. Let’s dig in, take a look at what caused the increase in rates in 2022 and whether or not we can expect a drop in rates in 2023.

SUMMARY: Rates went up so fast in 2022 due to an increase in inflation. Inflation is one of the best leading indicators for mortgage rates. When inflation is reduced through the efforts made from the Fed through increasing short-term rates to reduce spending we can expect mortgage rates to drop too. We are already seeing lower inflation numbers which has reduced rates, just not as much as normal. Mortgage rates and U.S. Treasure bonds normally have a spread of about 1.79% but we are currently seeing a spread of 2.99%. At a normal spread we would currently be seeing 30 year fixed mortgage rates at about 5.49%. As the market uncertainty calms and inflation slows we will likely see rates in the 5s by mid to late 2023. Right now, we are sitting at a nationwide average of 6.31%*

I believe that as mortgage rates go down buyer demand will return. Not as much as we experienced in 2021, but certainly more than we are experiencing right now. Use this window of opportunity to get better terms on your home purchase through reduced prices, rate buy downs and seller paid mortgage insurance. Then refinance when rates drop.

*(This is my prediction only and should not be relied upon for any financial decision. I might be completely wrong.)

Why Did Mortgage Rates Go Up So Fast?

On December 23, 2021 30 year fixed mortgage rates averaged just over 3% at 3.05% according to the Freddie Mac survey. That same survey showed 30 year fixed mortgage rates hit 7.08% on October 27, 2022. The last time we saw that rapid of an increase in mortgage rates was in the early 80s when mortgage rates hit 18.44%!

What do these two time-frames have in common? Inflation!

Inflation and Mortgage Rates are Connected

Mortgage rates follow inflation as you can clearly see in the chart above. When inflation (black line) goes up, 30 year fixed mortgage rates (blue line) follows. When mortgage rates hit 18.44% in October 1981 it was a result of record setting inflation which we are experiencing, once again, in 2022…and into 2023.

But Why Does Inflation Cause Mortgage Rates to Go Up?

Don’t care about the why? Just skip this section. But, if you’re the nerdy type who needs to understand the inner-workings then let’s dig in…

Mortgages are individual debts.

Those individual debts get packaged together into investments.

Groups of mortgage debts are called Mortgage Backed Securities (MBS).

MBS are investments.

MBS investments are most similar to the 10-Year U.S. Treasury Bonds.

10 Year U.S. Treasury Bonds are guaranteed by the U.S. government while mortgages are backed by borrowers repaying the mortgage debt, generally over a longer period of time. That means that mortgage backed securities are a higher risk investment than U.S. Treasury bonds and therefore must yield higher returns.

What Causes Bond Yields to Increase?

Bond prices are what impact bond yields. When there is demand for bonds, bond prices go up. When bond prices go up bond yields go down. Right now we are seeing the opposite: low demand for bonds and therefore increasing bond yields.

High inflation environments reduce the attractiveness of bonds, reducing their demand and driving up bond yields (to draw in bond investors). Since mortgage backed securities are basically bonds, mortgage rates are going up.

How Does the Fed Impact Mortgage Rates?

The Fed, or the Federal Reserve System is the Central Bank of the United States led by the Chairman. Currently, the Fed Chairman is Jerome Powell.

The Fed Does NOT Directly Impact Mortgage Rates

Instead the Fed impacts the federal funds target rate which guides overnight lending between banks. Basically, the Fed impacts short-term lending rates on debts such as credit cards, auto loans and home equity lines of credit. The cost of buying things, on credit, becomes more expense. Here is what happens:

Fed increases target rate.

Banks increase overnight rate.

Short-Term debt rates increase.

Cost to buy (with debt) becomes more expensive.

Demand drops due to higher cost.

Supply increases.

Cost of goods reduces (or doesn’t increase in price as quickly).

Inflation slows.

Per the previous point about mortgage rates following inflation, as the Fed increases rates to slow down the economy and reduce inflation, reducing mortgage rates, over time.

2023 Mortgage Rate Predictions

No one knows with certainty what will happen. There are too many factors that play into the U.S. (and world) economy to accurately forecast exactly what will happen. But there are clues as to what we can expect.

Inflation is Our Best Indicator

The Fed is increasing rates to slow the economy and get inflation under control.

Mortgage rates follow inflation.

When inflation drops, we can expect mortgage rates to drop too.

What’s Happening with Inflation?

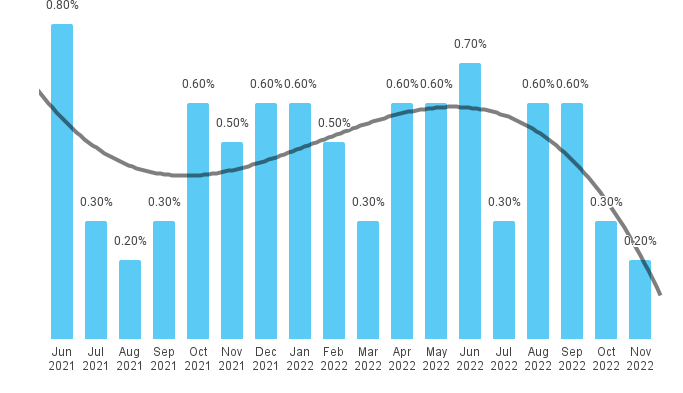

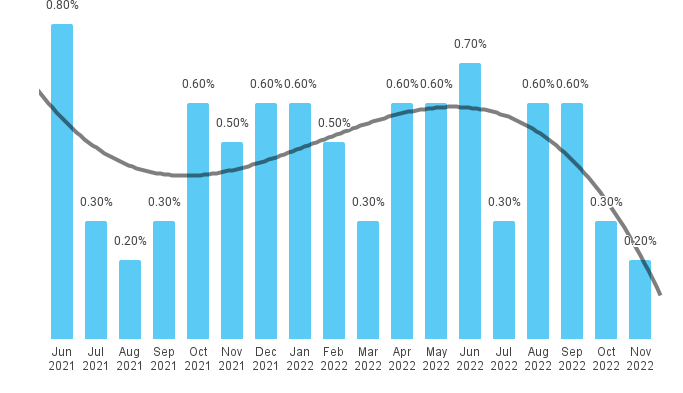

Inflation is calculated by taking the increase in goods each month over a period of 12 months.

Here’s what is happening with inflation. Inflation numbers from a year ago drop off while lower inflation numbers are released. In October 2022 we removed the 0.60% Oct 2021 number and added the 0.30% inflation number for Oct 2022 resulting in a drop of 0.30% in inflation. Similarly, in Nov we dropped off 0.50% and added on 0.20% for another 0.30% drop in inflation.

How Mortgage Rates Responded to Lower Inflation

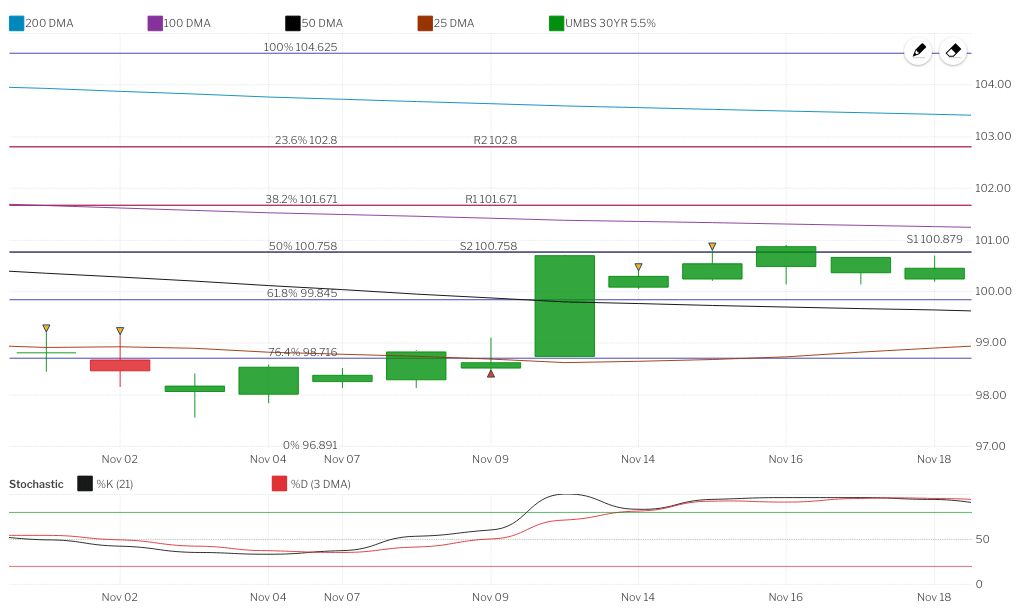

October inflation numbers were released on November 10, 2022. Here is the MBS chart between Nov 1 and Nov 18:

See that big green bar in the middle of the chart. That was an improvement in mortgage price (not rate) by 195 basis points (almost 2%). In other words, the cost of a mortgage became 2% of the loan amount less expensive.

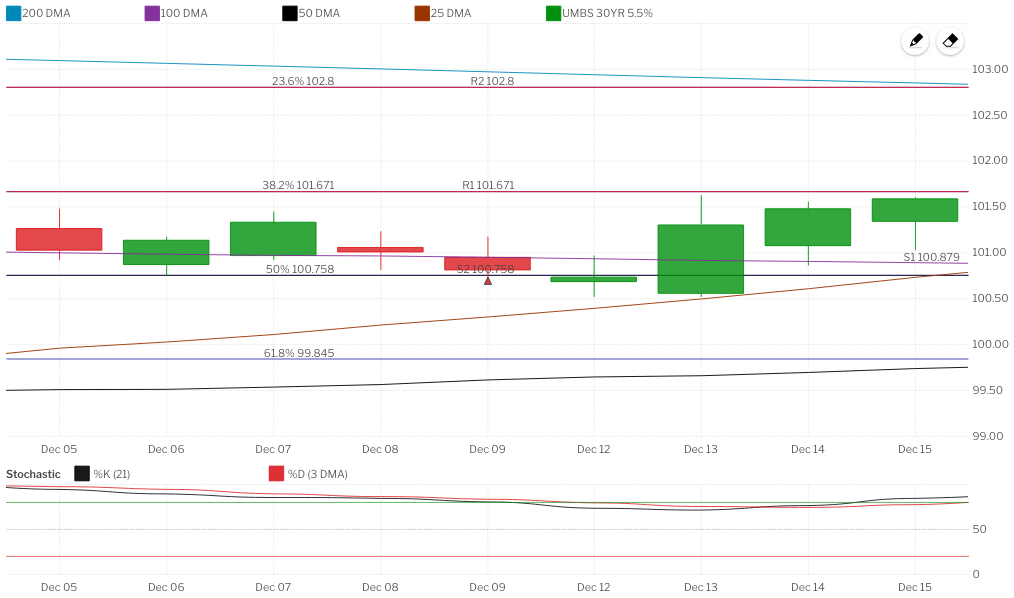

Here is what happened on December 13, 2022 when the November inflation numbers were released: (improvement of 75 bps)

Mortgage Rates are Responding to Lower Inflation Numbers

The markets are responding, as expected. As lower inflation numbers are being released, bond prices are going up, causing bond yields to go down, reducing mortgage rates.

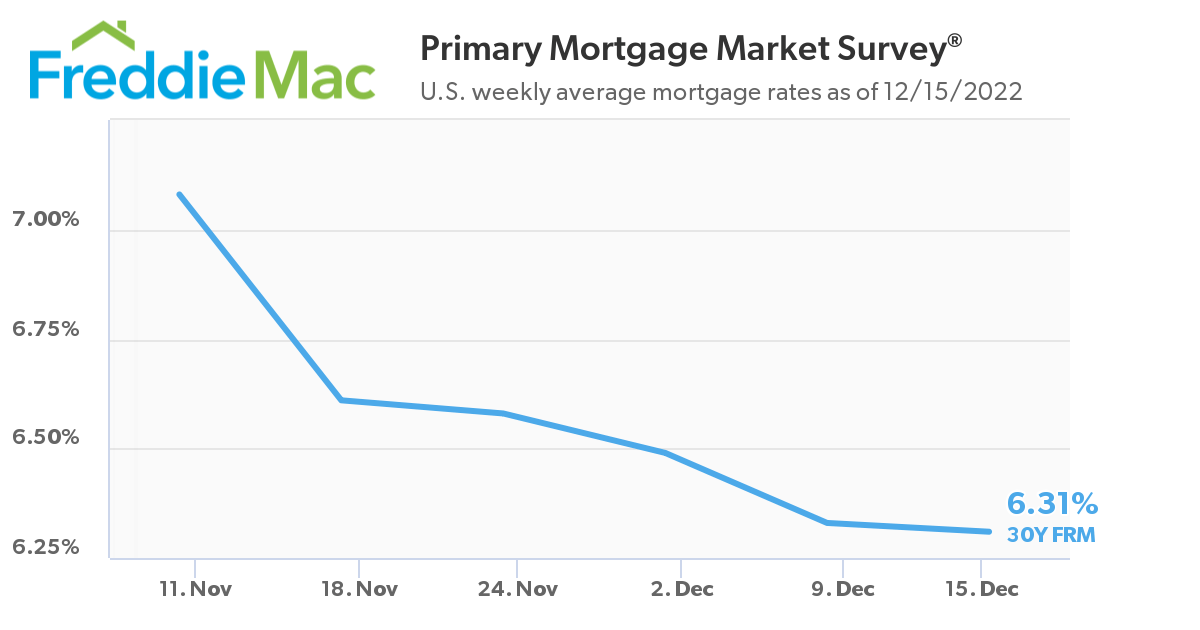

As you can see, since Nov 11 thru Dec 15, mortgage rates have dropped are are now averaging about 6.31%.

Keep in mind that 6.31% rate is a nationwide average for those with great credit, putting 20% down on a primary home purchase. Many factors can impact your rate.

Where are Mortgage Rates Headed?

Let’s return back to the inflation numbers…

This chart shows inflation numbers are headed down. The light gray line is the trend line which is going down. As the Fed continues to increase the fed funds rate, slowing the economy and reducing inflation the trend is likely to continue.

Look at the inflation numbers in Dec 2021, Jan 2022 and Feb 2022. All high numbers, similar to Oct & Nov 2021. If we see inflation numbers like we saw in Oct & Nov 2022 we can expect a rapid decline in inflation thru Feb 2023. And again in Apr – Jun. And finally Aug & Sep.

My prediction is that by mid to late 2023 we will likely see lower rates than we are seeing now.

Will We See Mortgage Rates in the 3s?

I don’t think we will see rates int he 3s again, any time soon. Anything is possible, of course, but those rates were an anomaly.

The average mortgage rate between Apr 2, 1971 and Dec 15, 2022 is 7.76%.

We know mortgages and the 10 Year Treasury Bond are closely related. Historically, the spread between U.S. Treasury Bonds and mortgage rates is 1.79%. Right now, the spread is 2.99%. If we were at the normal spread, 30 year fixed mortgage rates would be at 5.49%.

I expect, with lower inflation numbers ahead of us and markets returning to a normal spread we can expect rates in the low 5s by mid 2023.

(This is my prediction only and should not be relied upon for any financial decision. I might be completely wrong.)

Buy Now or Wait for Rates to Drop?

What happened before rates went up? The real estate market was in a frenzy with huge buyer demand and very few homes on the market. This drove up home prices and made negotiating a price on a home more like an auction with every additional buyer interested in a home driving the price up that much more.

My guess, is that you can expect a slightly cooled version of this as rates come back down. I don’t expect the full frenzy we saw in 2021 but I do expect buyer demand to increase and housing inventory levels staying low.

If you want the opportunity to negotiate better terms on your home purchase, now is a great time to do it. Consider options such as:

- Reduced Home Price

- Temporary Buydown

- Permanent Buydowns

- Seller Paid Single Premium Mortgage Insurance

If you are unfamiliar with any of these strategies, please contact us so we can provide you with the strategies our clients are using to make homes more affordable during this window of opprtunity.