How Smart Preparation Beats Waiting on Rates in 2026

Every housing market rewards a different behavior.

Some years reward speed.

Some reward patience.

2026 will reward preparation.

As we head into the new year, buyers are asking a familiar question:

“Should I wait for rates to drop?”

The data suggests a better question is:

“How do I create leverage if rates don’t?”

Because in 2026, leverage will not come from timing the market. It will come from being ready before the opportunity shows up.

What the 2026 Mortgage Rate Outlook Really Tells Us

Mortgage rates surged to a 23-year high in 2023, cooled modestly in 2024 and 2025, and are now expected to remain relatively stable throughout 2026.

As of late 2025, the national average 30-year fixed rate hovered around 6.18%. Forecasts from major housing authorities show remarkable alignment heading into the year ahead.

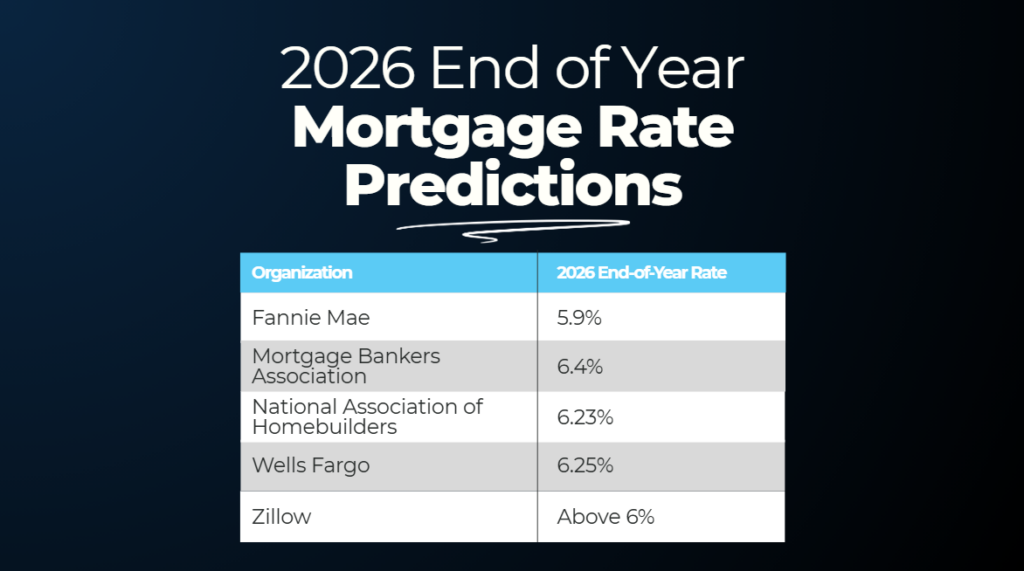

2026 Mortgage Rate Predictions

Most projections land in the low-to-mid 6% range by the end of 2026.

That matters because it changes the strategy.

This is not a “wait it out” market. It’s a “win with a plan” market.

Why Stable Rates Shift Power to Prepared Buyers

When rates stop swinging wildly, markets begin to normalize.

According to 2026 forecasts:

- Inventory is expected to rise nearly 9% year over year

- Home price growth slows to roughly 2% to 3.5%

- Existing home sales tick upward from long-term lows

- Monthly payments decline slightly for the first time since 2020

- Buyer negotiating power improves as competition softens

This is what a balanced market looks like.

Homes still sell. The good ones move quickly. But sellers become more responsive to certainty, clean offers, and qualified buyers.

Preparation becomes currency.

The Lock-In Effect Is Real and It’s Limiting Supply

Nearly 4 out of 5 homeowners with a mortgage have a rate below 6%. That reality keeps many would-be sellers on the sidelines.

As a result:

- Inventory recovers slowly, not suddenly

- Well-priced homes still attract attention

- The best opportunities go to buyers who can act decisively

Waiting for a flood of listings or a dramatic rate drop may leave buyers stuck longer than expected.

January Readiness Is How Buyers Create February Leverage

At NEO Home Loans, we see the pattern every year.

The buyers who win in February, March, and April are rarely the ones who started preparing then.

They are the ones who:

- Clarified their numbers early

- Strengthened their buying position before shopping

- Understood how to structure an offer strategically

- Were ready when the right home appeared

Leverage is created before the listing hits the market.

What “Being Prepared” Actually Means at NEO

Preparation is more than a pre-approval letter.

NEO helps buyers prepare on three levels.

- Financial Clarity

We go beyond surface-level numbers to help buyers:

- Understand true buying power, not just a payment estimate

- See how down payment choices impact both rate and affordability

- Model multiple scenarios so decisions are proactive, not reactive

- Offer Strength

In a balanced market, sellers choose certainty.

NEO helps buyers:

- Get fully underwritten earlier in the process

- Reduce friction and surprises in escrow

- Present offers that stand out even without overpaying

- Strategy Over Guesswork

Markets don’t reward hope. They reward planning.

We guide buyers through:

- Builder incentives and rate buydowns

- New construction opportunities where pricing and concessions are strongest

- Negotiation strategies that align with current inventory and demand

This is how preparation turns into leverage.

New Construction Is Creating Quiet Opportunities

One of the biggest advantages in today’s market is new construction.

Builders are motivated sellers in 2026. Many are offering:

- Mortgage rate buydowns

- Closing cost credits

- Below-market financing options

In several regions, new homes now cost less per square foot than existing homes, and builders are filling the gap left by limited entry-level resale inventory.

Prepared buyers are the ones positioned to take advantage.

Affordability Improves Slowly but Meaningfully

Even with modest home price growth, affordability is improving.

Why?

- Mortgage rates stabilize instead of rising

- Incomes are expected to outpace inflation

- Real, inflation-adjusted home prices soften slightly

For the first time since 2022, the typical mortgage payment is projected to fall below 30% of median income, a meaningful psychological and financial threshold

It may not feel dramatic day to day, but it changes what’s possible for prepared buyers.

The Market Is Not Easy, But It Is Winnable

2026 will not be effortless for buyers.

Affordability remains a challenge. Inventory is still below pre-pandemic norms. Rates are not returning to 3%.

But this is no longer a market where buyers are powerless.

Negotiating power is improving. Inventory is growing. Sellers are adjusting expectations.

The buyers who succeed will not be the ones waiting for perfect conditions. They will be the ones who planned for real ones.

How to Take the Next Step

If buying a home is part of your 2026 plan, January is not too early.

It’s exactly on time.

Start preparing now to unlock more inventory, better affordability, and stronger negotiating power when it matters most.

At NEO Home Loans, we don’t chase the market. We help you prepare for it.

When opportunity shows up, you’re ready.