Are you still waiting for prices to fall before you purchase a home? Well, according to several recent home price reports, the time for waiting might be up.

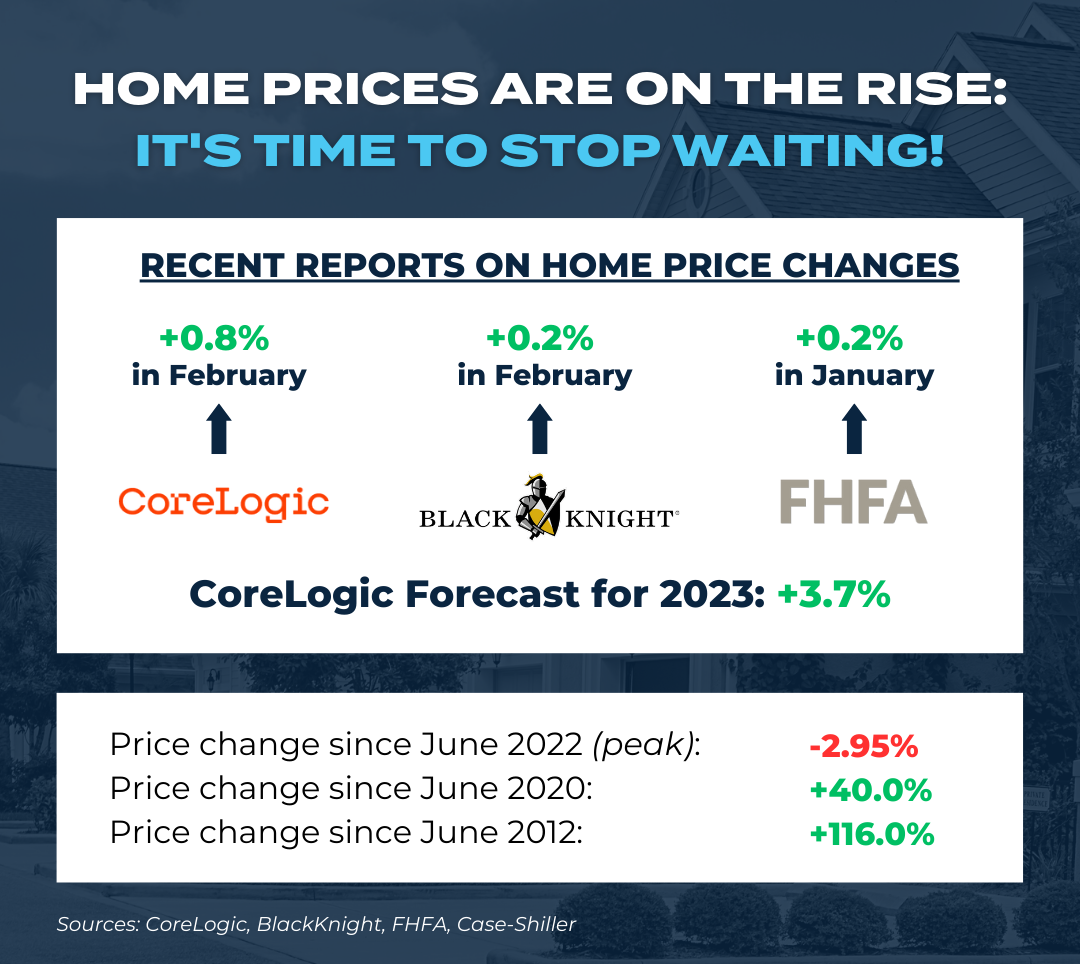

According to reports from Black Knight, CoreLogic, and the Federal Housing Finance Agency (FHFA), home prices are rising nationwide for the first time in eight months:

- Black Knight reported a 0.16% monthly increase in February (compared to January), and a 1.96% annual increase (compared to February 2022).

- CoreLogic reported a 0.8% monthly increase in February, and a 4.4% annual increase.

- FHFA reported a 0.2% monthly increase in January (the latest data available), and a 5.3% annual increase.

Why are prices rising? Because lower interest rates are increasing the demand for homes in a market with persistently low inventory – and that scarce supply isn’t getting any better.

According to Black Knight, February marked the fifth straight month of housing inventory decline, and it has put the United States in the largest housing inventory deficit since May of 2022.

“New listings – already trending well below pre-pandemic levels for months – ran 27% below those levels in February as potential home sellers continued to shy away from the market. All in, total active for-sale inventory is back to 47% below pre-pandemic levels after having recovered to within 38% of normal levels late last year.

Without a significant shift in interest rates, home prices or household income, this is a self-fulfilling dynamic that is quite likely to continue for some time.”

– Black Knight’s February 2023 Mortgage Monitor

Low-inventory will continue to be a challenge

Persistently low inventory is being made even worse by the absence of new listings – one of the biggest challenges the housing market is going to continue to face this year.

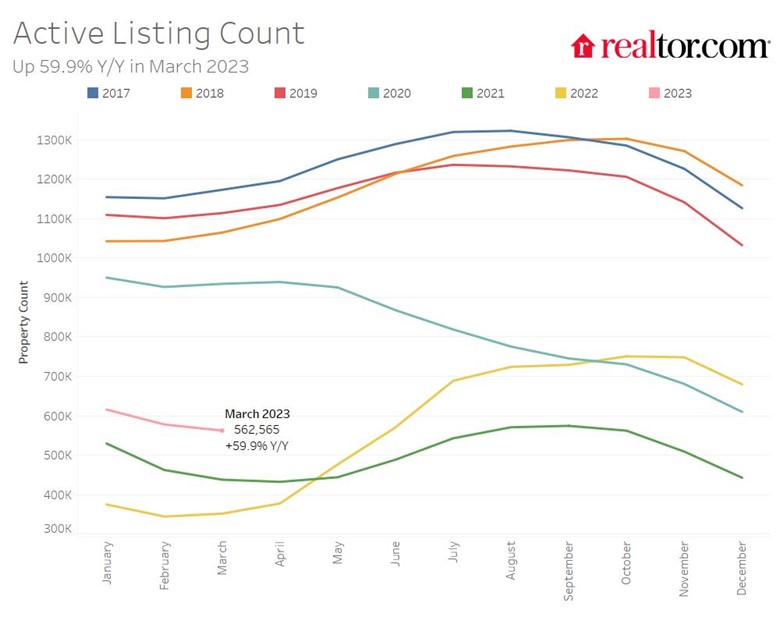

In a typical market (aka pre-2020), housing inventory always increases in March as the busy Spring and Summer buying seasons begin. However, this year marks the first year since 2017 (excluding the abnormal markets of 2020 and 2021) that inventory has declined from February to March.

New listings are so low because many homeowners were able to lock in record low interest rates in 2020 and 2021. According to data from Black Knight, over 80% of homeowners with mortgages have an interest rate below 5%. Those homeowners who bought or refinanced with low rates are reluctant to sell their homes and be saddled with a much higher rate and monthly payment.

What’s Next?

Home prices are on the rise because there is not enough inventory to meet the demand, and that imbalance is only going to worsen as we move through the year. CoreLogic forecasts home prices will increase 3.7% annually by February 2024.

Luckily, even though prices will continue to increase, we believe interest rates will come down even more this year.

Rates hit lows this week that we only briefly saw in December and January. This time the decline was from weaker than expected labor reports, furthering the argument that our economy is heading into a bad recession, which as we know from history will bring with it lower rates.

All of this is to say, if you are ready to purchase a home but you have been waiting for prices to fall, now is the time to get moving. Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.