How confident are you that you’ll be able to retire comfortably?

There’s a lot of discourse out there about whether or not the United States is heading for a retirement crisis. This conversation has been kicked to the forefront again in recent weeks with the news of France announcing reforms of their pension system that will push the retirement age from 62 to 64.

Unfortunately, Americans just do not have enough saved for retirement. A recent report by PWC analyzing US Federal Reserve data shows that one in four Americans (including 27% who consider themselves retired) have absolutely NOTHING saved.

Anyone who has not been able to save much for retirement will depend solely on Social Security – and that typically replaces only about 40% of pre-retirement income. However, it’s highly likely that we will see major reforms in social security. The Congressional Budget Office estimates that social security reserves will be depleted by 2033.

With inflation rising, the stock market growing increasingly volatile, and social security drying up, you need to take matters into your own hands when it comes to your financial future! And the best way to do that is through real estate – specifically, building a portfolio of rental properties.

Building a Safe and Early Retirement with Real Estate Investing

Real estate investing for retirement comes with a plethora of upsides. Whether you are hoping to retire young or catch up on your retirement savings later in life, capitalizing on these unique benefits of real estate investing will allow you to build your retirement income quickly and safely.

Rental Income and Rising Equity

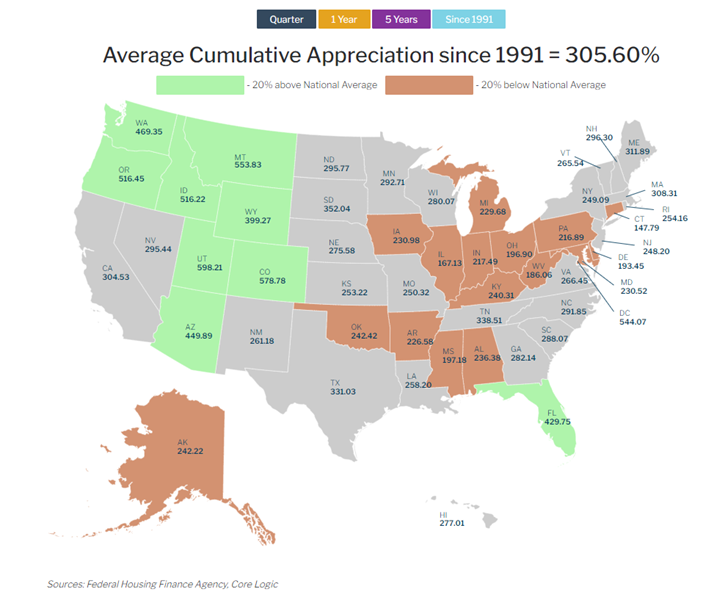

Real estate appreciates over time at a greater rate than inflation. Combined with the rental income over the years, the actual rate of return can be staggering.

If you’re worried about home prices falling, take a look at the chart below. Real estate values have gone up 73 out of the last 80 years – that’s a pretty good indicator of future performance.

If you invested in just one rental property today, you would immediately see your wealth grow from two directions at once. Your property value would appreciate over the years, and at the same time your tenant would be paying down your mortgage for you – your debt would be shrinking as your property value rises!

Rents also rise alongside inflation, and in many cases rise faster. That’s because rents are a primary driver of inflation.

Your property rents for $2,500 the year you buy it. The next year, you raise the rent by a conservative 3%. And then you do the same next year, and the year after that. Your real returns stay the same, or even improve over time.

Eventually, your tenant would pay off your mortgage entirely, leaving you with a free and clear asset and even greater cash flow for retirement income.

The Power of Leverage and Rental Income

Imagine you have $250,000 cash that you would like to invest in real estate. You could buy a small rental property and earn a modest return on your investment through rental income, but it likely would not be much more than you would see if you invested in other assets over the long term.

Using the common 1% rule (monthly rental income should be 1% of the purchase price), you would charge $2,500 rent for the $250,000 property. The 1% rule is also commonly applied to maintenance and operating costs, meaning it would cost you 1% of the property value to maintain the property each year. For this example, that would be $208 per month. Subtract that from the rent and you have a monthly cash flow of $2,292.

Now let’s break this down by looking at cash-on-cash returns (the annual cash income earned on the cash you invested).

By purchasing just the one rental property with cash, your annual rental income would be $27,504. This means your cash-on-cash return would be 11% ($27,504 annual rent / $250,000 investment = 11%). Not a bad return on investment at all.

But the real returns come with leverage. Instead of buying just one property for cash, you could use the power of leverage and buy five properties for $250,000 each, financing 80% of the purchase price and putting down the other 20% with your cash. Beyond helping you scale five times as fast, this strategy would also dramatically improve your cash returns.

Say that for each of those $250,000 properties, you borrow $200,000 for a 30-year mortgage at a fixed rate of 6.5%. Your monthly mortgage payment for each property would be approximately $1,500 with principal, interest, taxes, and insurance. This means your monthly cash flow would be $792 per property, or $3,960 total.

That increases your annual cash-on-cash return from 11% to 19%!

And those returns actually improve even more over time. That mortgage payment stays fixed as the years and decades pass, even as rents rise to keep up with inflation. That means that the spread between your mortgage payment and your rent actually grows much faster than the rise in rent alone.

If you raised the rent on one of the properties above by a modest 3%, it would be a $75 total increase. But a $75 increase in the spread between your mortgage payment and your rent ($1,000 in our scenario) would mean a 7.5% increase in your margin.

And that’s just in the first year alone! Over time, your rent increases would build upon each other even as your mortgage payment stays fixed.

The Power of Leverage and Appreciation

Using leverage to purchase multiple properties can dramatically increase the cash return on your investment and provide you with a consistent income, but it gets even better – the returns we’ve already discussed don’t even take into account the wealth you would be building through appreciation alone.

In 2022, home prices appreciated an average of 6% nationally. If you had purchased just one $250,000 home with cash last year, your return on that investment would have been 6% over 12 months.

But appreciation is not realized just on the amount you invested…it’s realized on the entire value of the home (you can probably see where this is going).

If you owned five properties each worth $250,000 last year, with 80% leverage your return on investment would jump to a staggering 30% in just one year!

Add this “leveraged appreciation” to the return you would be getting on rental income, and you have a rapid increase in your net worth that is unmatched by any other investment out there.

The Bottom Line

While purchasing and owning rental properties does require more knowledge and more labor than stocks, the returns are unmatched. It’s that same barrier of entry that keeps everyone from investing in them, which keeps the returns strong.

Investing in real estate is a great step towards achieving financial freedom, and it is one of the most effective ways to build a safe and early retirement. Take advantage of the perks above to scale your passive income faster and grow your net worth faster, so you can escape the rat race and be confident you will have a comfortable nest egg in your later years.

Take the time to learn how to find good deals and how to calculate rental cash flow. Once you know how to do that, you can create ongoing sources of passive cash flow that only rise in value and income with every year that goes by.