To Whom It May Concern:

This letter confirms that the Wynn & Eagan Team at Neo Home Loans has issued a ROCK SOLID Pre-Approval for:

[xyz-ips snippet=”PreA-Client”]

The Wynn & Eagan Team does not issue pre-approvals without 100% certainty that our customer can qualify. Here is what we have obtained (at a minimum) and reviewed prior to issuing the pre-approval:

- Complete Loan Application

- Credit Check

- Tax Returns

- W2s

- Pay Check Statements

- Bank Statements

- Automated Underwriting Approval

- 62 Point Pre-Approval Checklist

At this time, please consider the above mentioned borrower(s) pre-approved for a purchase price of $[xyz-ips snippet=”PreA-Price”].

If you have any further questions regarding their qualifications, or if we may be of further assistance in any way, please contact us anytime. We look forward to working with you.

[xyz-ips snippet=”PreA-LO”]

Wynn & Eagan Team at Neo Home Loans

[xyz-ips snippet=”PreA-Phone”]

[xyz-ips snippet=”PreA-Email”]

ENCLOSURES:

Don’t Accept an Offer from a Pre-Approved Buyer!

4 Reasons to Select Our Clients’ Offer

Equal Housing Lender | Visit https://www.wynnteam.com/about/licenses/ for detail on our licenses

Don’t Accept an Offer from a Pre-Approved Buyer!

You have a big responsibility in today’s real estate market. Protecting and advising your seller is likely at the top of your list when working as a listing agent. How do you do that when you receive multiple offers? Here’s how…

Don’t Accept an Offer from a Pre-Approved Buyer!

Probably not what you expected to hear from a lender, right?! More and more online lenders have entered the business offering “pre-approvals” within minutes but you and I both know those “pre-approvals” don’t stand up to the weight of a real transaction causing last minute problems or even closing delays. How do you know if the buyer’s “pre-approval” is strong enough to get to closing…on time?

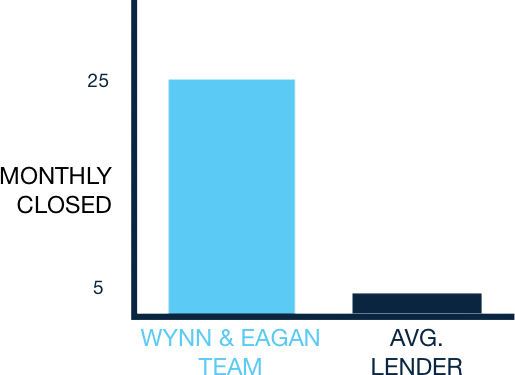

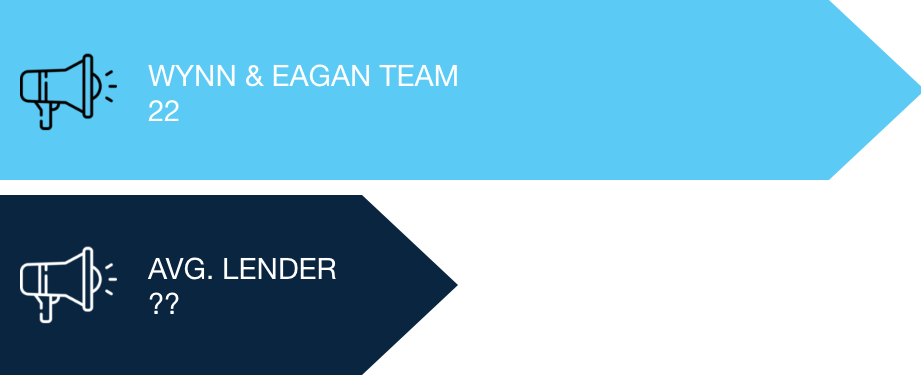

While most mortgage lenders offer the minimum standard pre-approvals the Wynn & Eagan Team at Neo Home Loans is unique by continuing to push the industry to a higher standard. We believe in a thorough qualification process that results in a smoother, more enjoyable and less stressful home buying and mortgage process. Check this out:

|

|

|

The Wynn & Eagan Team at Neo Home Loan’s ROCK SOLID PRE-APPROVAL stands above the typical mortgage lender’s “pre-approval”. When we issue our ROCK SOLID PRE-APPROVAL we have done our due diligence to ensure the buyer can close! Not only do we collect the documents to verify the information collected on the loan application we also complete a 62-point checklist that has been developed over 20 years and thousands of mortgage loans to ensure we have thought through everything that could jeopardize the pre-approval so you can rest easy knowing the buyer is qualified to buy your listing.

✔️ Having a ROCK SOLID Pre-Approved buyer gives you 100% confidence that our buyer is qualified and able to close!

4 REASONS to choose OUR CLIENTS’ OFFER

| We Close More We close about 25 loans a month. Closing more means more experience!

|

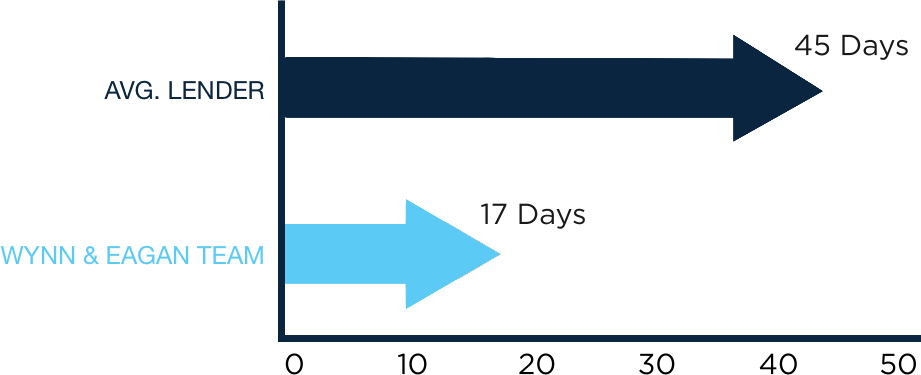

We Close Faster Our typical turn time is 17 days where the average lender is 45 days.  |

| Better Communication Proactive touchpoints at every major milestone & every Friday throughout the entire transaction!

|

Proven Track Record 100+ combined Google, Facebook, Yelp & Zillow 5-star reviews.

|