For those with a long-term mindset, investing in real estate in 2023 will be a great way to build a lot of wealth.

If you own a home or have been interested in buying one, you are likely aware of the sizeable U.S. residential real estate downturn. This is creating a golden opportunity for those who want to invest in rental properties.

Recent rate rises have affected home values. They have severely impacted home affordability, and many would-be homebuyers have dropped out of the market for the time being. We’re seeing “price lowered” on listings for the first time in years.

This means the housing market is starting to balance. No longer are we in a “seller’s” market, which is ideal for all homebuyers but especially ones who want to invest in rental properties.

Big-Time Investors See Opportunity

We’re not the only in our positive outlook on the current market. Don Mullen, a former Goldman Sachs executive who was part of a big bet on the housing market following the 2008 crash, says he sees plenty of opportunity ahead.

In a recent interview with Bloomberg, Mullen explained why the current housing climate is different from 2008, and it’s something we’re very familiar with: supply and demand.

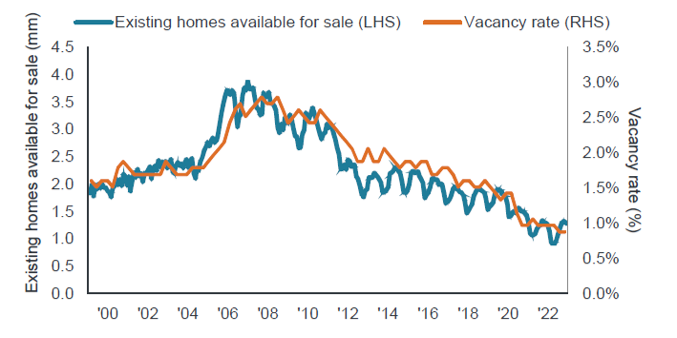

“We have more people than houses. The millennial generation is the biggest generation since the baby boomers; they’re all reaching household formation years. I think we have 12.6% household formation growth and 8% housing growth. But we started out this process already short 4 million houses relative to people. People over 60 used to sell their house and recycle it back to the young generation. People don’t sell their house at 60 anymore. So we underbuilt houses and have the largest generation since the baby boomers, and seniors are keeping their houses longer.”

He goes on to say that the reason prices won’t go down is because homeowners with outstanding mortgages at 3% aren’t listing their homes for sale. Additionally, interest rates are making homeownership less affordable for many people. So as a result, we are seeing a net increase in renters.

The kicker? This is happening at a time when a lot of investors are getting OUT of the residential real estate market.

“Homeownership has been going up until very recently. What’s been happening is that the entrepreneurial average owner of a single-family home for rent—the doctor, dentist, lawyer, gas station owner, electrician, all those other people—they’re selling their houses, getting out of the business. You’ve actually shrunk the availability of rental housing stock for the last several years.”

These mom-and-pop investors aren’t the only ones. iBuyers (companies that use technology to make quick offers on homes) are exiting the market in droves and selling off their inventory at discounted prices. Many homebuilders have also been spooked by the correction, pulling back their production and trying to clear their inventory as well while demand is down.

Mullen believes investors will be able to find discounted properties from homeowners, but the real savings will be realized by purchasing from the institutional investors and home builders:

“Where are you going to buy houses? If you’re buying them from homeowners, they’re going to go down 3% to 5%. Where are you going to buy them from homebuilders? At 20% to 30% discounts from the peak.”

What Does This Mean for Investors?

There is a window of opportunity for property investors with a long-term focus. Consumer confidence is low (although it is rising) and many prospective homebuyers and investors are sitting on the sidelines or trying hard to sell their properties. This means there are more homes available to purchase at a discounted price, and even room for more negotiation for seller credits to assist with down payment, closing costs, or an interest rate buydown.

The amount of available homes for rent is also decreasing while demand for rental properties is increasing. This bodes very well for rental income.

Investing in a rental property may not be as cheap as it was, but home prices will bounce back and continue to see average single-digit appreciation like they always have. In three years’ time, you may be in the same spot you are today – looking back and wishing you had invested three years ago.

Now, we know investing in a rental property does not make sense for everyone. There are many factors of your overall financial picture to take into account when deciding if it is the right decision. That’s why you need an advisor who takes a holistic approach to your wealth creation.

Attaining wealth doesn’t just happen – it’s the result of a well-executed plan. At NEO Home Loans, we are not just a team of mortgage loan officers – we are mortgage advisors. Our goal is to help you use your home purchase to grow, protect, and pass on your wealth in a way that makes sense for YOU.

If you are interested in growing your wealth by purchasing a rental property, fill out the form below to request a consultation with one of our mortgage advisors. They will meet you with and help you understand the current market, clearly explain the investment mortgage programs that are available, and ensure you make the right decision through strategic financial planning and wealth advice.