Are you thinking about buying a home, but worried that high interest rates might put your dream out of reach? It’s a common concern, but don’t let it deter you just yet. In fact, buying a home in a high-interest market can actually be a smart move for savvy buyers.

How so? Well, for starters, a high-interest market typically means that home prices are lower. That’s because higher interest rates make it more expensive to borrow money, so buyers have less purchasing power. As a result, sellers may need to lower their prices to attract buyers.

But that’s not the only advantage. By buying a home when interest rates are high, you may also be able to lock in a lower rate than you would in a lower interest rate market. That’s because interest rates tend to fluctuate over time, and what goes up must eventually come down (and vice versa). So if you buy a home at a time when rates are high, you may be able to refinance later on when rates go down.

Of course, there are some potential drawbacks to consider as well. But don’t worry, we’ll cover those in more detail later on. For now, let’s focus on the positives and explore why buying a home in a high-interest market could be a smart move for you.

Benefits of Buying a Home in a High-Interest Market

While it’s true that buying a home in a high-interest market can come with its fair share of challenges, there are also some potential benefits to consider. Here are a few reasons why it might make sense to buy a home when interest rates are high:

High Interest Rates Can Lead to Lower Home Prices

One of the biggest advantages of buying a home in a high-interest market is that home prices are often lower. This is because higher interest rates can reduce buyer purchasing power, which can in turn put downward pressure on home prices.

To see how this works in practice, consider an example. Let’s say that you’re looking to buy a $500,000 home, and you’re able to put down a 20% down payment ($100,000). If interest rates are 3.5%, your monthly mortgage payment would be around $1,796.

Now let’s say that interest rates increase to 5.5%. With the same down payment and home price, your monthly payment would increase to $2,242 – a difference of almost $450 per month.

For many buyers, that extra $450 per month can be a dealbreaker. It might mean that they have to look for a less expensive home or delay their home buying plans altogether. And if enough buyers are in the same boat, sellers may need to lower their prices in order to get their home sold.

Of course, there are other factors that can impact home prices as well, such as local market conditions, supply and demand, and economic trends. But all else being equal, higher interest rates can make it harder for buyers to afford a given home, which can put pressure on sellers to lower their prices in order to make a sale.

Overall, if you’re looking to buy a home in a high-interest market, keep an eye on home prices and be prepared to negotiate. You may be able to snag a good deal if you’re patient and persistent.

Lock In a Lower Rate and Refinance Later

Another advantage of buying a home in a high-interest market is that you may be able to lock in a lower interest rate than you would in a lower-interest market. This might sound counterintuitive at first, but bear with us – it actually makes sense.

Here’s why: when interest rates are high, sellers are often more willing to negotiate and offer sellers concessions in order to attract buyers. These concessions can be used to pay for things like closing costs, but the smartest move is to use them for an interest rate buydown.

By using seller concessions to buy down your interest rate, you can significantly lower your payment for the first two or three years of your mortgage. If rates come down, you can then refinance and use the remaining buy down funds to cover all or part of the lender fees and closing costs.

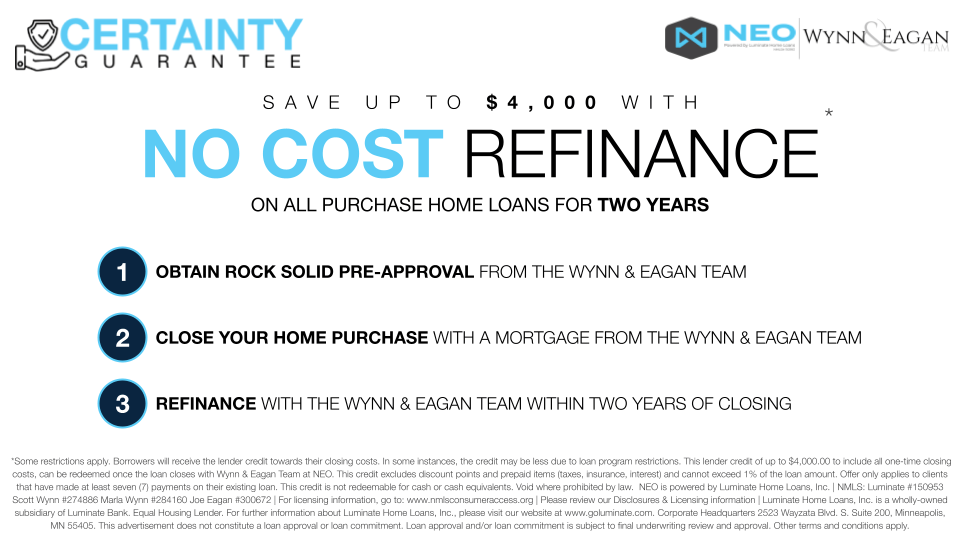

Of course, refinancing isn’t always the right move – there are costs and fees to consider (although with our Certainty Guarantee you can refinance with no costs!), and you’ll want to make sure that you’re getting a better deal overall. But if you’re able to lock in a low rate in a high-interest market, it can give you more flexibility and options down the line.

Overall, if you’re considering buying a home in a high-interest market, it’s a smart move to ask for seller concessions to lower your rate in the short-term and explore refinancing later on. It may take some extra effort, but it could pay off in the long run.

Potential Drawbacks of Buying a Home in a High-Interest Market

While there are certainly benefits to buying a home in a high-interest market, it’s important to also consider the potential drawbacks. Let’s look at some of the downsides of buying in a high-interest market, and what you can do to mitigate them.

Reduced Affordability and Purchasing Power

One of the biggest challenges of buying a home in a high-interest market is that it can impact your affordability and purchasing power. When interest rates are high, the cost of borrowing money increases, which means that you’ll end up paying more in interest over the life of your loan.

This can have a significant impact on your monthly mortgage payments. An increase in rate from 3.5% to 5.5% on a $500,000 home purchase with 20% down would mean an extra $450 per month. That might not sound like much, but it can make a big difference in terms of what you can afford. It might mean that you have to look for a less expensive home or delay your home buying plans altogether.

In addition, higher interest rates can also impact your purchasing power. When interest rates are high, lenders are often more cautious and may be less willing to lend you as much money. This can limit your options when it comes to finding a home that meets your needs and budget.

Overall, it’s important to be realistic about your affordability and purchasing power when buying a home in a high-interest market. Make sure that you’re comfortable with your monthly mortgage payments and have a clear understanding of how much you can borrow. It’s also always a good idea to get pre-approved for a mortgage before you start shopping for a home, so that you have a better sense of what you can afford.

Increased Monthly Mortgage Payments and Overall Borrowing Costs

Another major downside of buying a home in a high-interest market is that it can lead to higher monthly mortgage payments and overall borrowing costs. When interest rates are high, the amount of interest you’ll pay over the life of your loan increases, which means that you’ll end up paying more for your home in the long run.

Higher interest rates can also impact your monthly mortgage payments, like we mentioned above. These higher monthly payments can make it harder to make ends meet and impact your overall financial situation. They can also limit your ability to save for other goals, like retirement or a child’s education.

Overall, it’s important to be aware of how higher interest rates can impact your overall borrowing costs and monthly mortgage payments. Make sure that you’re comfortable with the payments you’ll need to make and that you have a clear understanding of the total cost of borrowing over the life of your loan.

Strategies for Buying a Home in a High-Interest Market

While buying a home in a high-interest market can be challenging, there are strategies that you can use to make the process more manageable. Let’s explore some of the best strategies for buying a home in a high-interest market, including ways to save money on your mortgage, increase your borrowing power, and negotiate with sellers.

Maximize Your Purchasing Power and Affordability

When interest rates are high, it’s important to do everything you can to maximize your purchasing power and affordability. Here are some tips to help you do just that:

- Save for a Larger Down Payment: One of the best ways to increase your purchasing power is to save for a larger down payment. By putting more money down upfront, you can reduce the amount you need to borrow and potentially qualify for a lower interest rate.

- Improve Your Credit Score: Your credit score plays a big role in determining the interest rate you’ll qualify for. By improving your credit score, you can potentially qualify for a lower interest rate, which can save you money on your monthly mortgage payments.

- Consider an Adjustable-Rate Mortgage (ARM): While fixed-rate mortgages are the most popular choice for homebuyers, an adjustable-rate mortgage (ARM) can be a good option if you plan to sell or refinance within a few years. ARMs typically offer lower interest rates upfront, which can help you save money in the short term.

- Be Prepared to Negotiate: When you find a home you love, be prepared to negotiate with the seller. In a high-interest market, sellers may be more willing to negotiate on price, closing costs, or other expenses to close the deal.

By following these tips, you can help maximize your purchasing power and affordability when buying a home in a high-interest market. Remember to stay realistic about your budget and financial situation, and always work with a trusted mortgage advisor who can help guide you through the process and help you create a mortgage strategy that makes sense for you and your financial goals.

Potential Negotiation Tactics and Ways to Get a Better Deal

In a high-interest market, buyers may feel like they have less leverage when it comes to negotiating with sellers. However, there are still tactics you can use to potentially get a better deal. Here are some negotiation strategies to keep in mind:

- Work with a Skilled Real Estate Agent: A skilled real estate agent can help you negotiate with sellers by providing you with valuable information about the property, the market, and the seller’s motivations. A good agent can also help you draft a strong offer and communicate with the seller’s agent.

- Be Flexible with Timing: If the seller is in a hurry to close, you may be able to negotiate a better price by offering a faster closing date. On the other hand, if you’re not in a hurry, you may be able to negotiate a better price by offering a longer closing date or a rent-back agreement.

- Look for Properties that Need Work: Properties that need some work or updating may be priced lower than move-in ready homes. If you’re handy or willing to put in some sweat equity, you may be able to negotiate a better price on a fixer-upper.

- Focus on the Total Cost of Ownership: When negotiating with a seller, don’t just focus on the purchase price. Consider the total cost of ownership, including property taxes, maintenance, and repairs. If the property needs a lot of work, you may be able to negotiate a lower price based on these additional costs.

- Ask for Closing Costs: In a high-interest market, closing costs can be a significant expense. Consider asking the seller to cover some or all of the closing costs as part of the negotiation.

By using these negotiation tactics, you may be able to get a better deal on a home in a high-interest market. Remember to be respectful and professional when communicating with the seller or their agent, and always be willing to walk away if the deal doesn’t meet your needs.

Key Factors to Consider When Getting a Mortgage

When buying a home in a high-interest market, it’s important to carefully consider your lender and mortgage product. Here are some key factors to keep in mind:

- Interest Rates and Fees: Obviously, you’ll want to find a lender with competitive interest rates and fees. However, keep in mind that the lowest interest rate isn’t always the best option. Some lenders may offer lower rates but charge higher fees or have more restrictive terms. Be sure to compare the total cost of borrowing when evaluating different mortgage products.

- Loan Type: There are a variety of mortgage types available, including fixed-rate, adjustable-rate, FHA, VA, and more. Each type has its own benefits and drawbacks, so it’s important to consider your personal financial situation and goals when choosing a loan type. For example, if you plan to stay in your home for a long time, a fixed-rate mortgage may be a better choice than an adjustable-rate mortgage.

- Down Payment Requirements: The amount of money you have for a down payment can impact your ability to qualify for certain mortgage products. Be sure to ask your lender about their down payment requirements and any programs they offer to help buyers with limited funds.

- Qualification Requirements: Each lender may have different qualification requirements for borrowers. Be sure to ask about minimum credit scores, debt-to-income ratios, and other factors that may impact your ability to qualify for a mortgage.

- Customer Service: Finally, don’t forget to consider the lender’s customer service reputation. You’ll want to work with a lender who is responsive, helpful, and transparent throughout the home buying process.

By considering these key factors when selecting a lender and mortgage product, you can maximize your chances of finding a mortgage that meets your needs and helps you navigate the high-interest market.

Final Thoughts

Buying a home when interest rates are high can present both challenges and opportunities. While high-interest rates may impact affordability and purchasing power, there are strategies that buyers can employ to maximize their chances of success. These include working with an experienced lender, maximizing down payments, negotiating the purchase price, and being flexible with location and property type.

When it comes to selecting a lender, it’s important to consider a variety of factors, including overall loan cost, loan types, and qualification requirements. By doing your research and working with an experienced mortgage advisor who cares about your overall financial success, you can ensure that you’re working with a trusted partner who will help you navigate the complex process of buying a home in a high-interest market.

Overall, while it may take a bit more effort and flexibility to buy a home when interest rates are high, it can still be a smart investment for those who are prepared and patient. With the right approach and the help of a trusted mortgage team, you can find a home that fits your needs and your budget – even in a challenging market.