Housing prices have skyrocketed over the last couple of years for three big reasons:

- Historically low interest rates

- Lower inventory of homes coming to market due to homeowners choosing to refinance instead of sell

- Low inventory of homes also due to the pandemic-driven hesitation to sell

Those three forces lead to a perfect economic storm driving up home prices: a huge imbalance of high demand and low supply.

Lately, because of the state of the market, some “experts” are shouting that the housing market is heading for a collapse in 2023. But is that really the truth? NO!

Not only do we believe housing is still a great investment that will go a long way toward helping you create wealth and build a secure retirement, we also believe now is one of the best times to buy that we’ve seen in the last couple of years.

The Housing Market Is Not A Bubble Ready to Burst

The previous 2008 housing crash was caused by loose lending practices which increased the number of buyers and drove up home prices. Many of those homebuyers were unqualified, should have never been approved by lenders, and couldn’t afford the homes they purchased in the first place. Consequently, a significant portion of those buyers defaulted a few years later. That led to an increased supply of homes on the market at reduced prices.

Things could not be more different today. Lending practices now are highly regulated, and all buyers must go through a deeply thorough loan underwriting process. Lenders have been very strict in qualifying buyers, and credit scores of approved buyers have stayed high. Most real estate professionals — including 60% of respondents in a recent survey by Zillow — do not believe we’re in a housing bubble that’s heading for a pop.

Rents Are Increasing at a Historic Rate

Whereas a monthly mortgage payment is fixed, rents increase over time.

Although rent growth has slowed in 2022, it’s still rising faster than it did in the years before the pandemic. According to Apartmentlist.com, rents are up 4.7% since January of this year. Since 1980, rents have increased at an average of 8.85% every year.

With high inflation still plaguing the economy, rents are likely to continue to rise. This makes a strong case for investing in real estate now. Not only will you shield yourself from that increase by locking in your monthly housing payment with a fixed-rate mortgage, but you also have the opportunity to benefit from increasing rental income if you decide to rent out your property.

Homes Are Becoming More Affordable

Because high interest rates have throttled housing affordability over the past few months, many would-be buyers have dropped out of the market. This has led to sellers being forced to drop their list prices to attract buyers.

But that’s not the only good sign for buyers. Supply and demand are also becoming more balanced as more inventory comes into the market. This means we are no longer in a completely one-sided “seller’s” market.

Rising interest rates, which increase a homebuyer’s monthly mortgage payment, reduce the number of buyers and put downward pressure on housing prices. Less competition and lower prices are always an upside for those looking to buy!

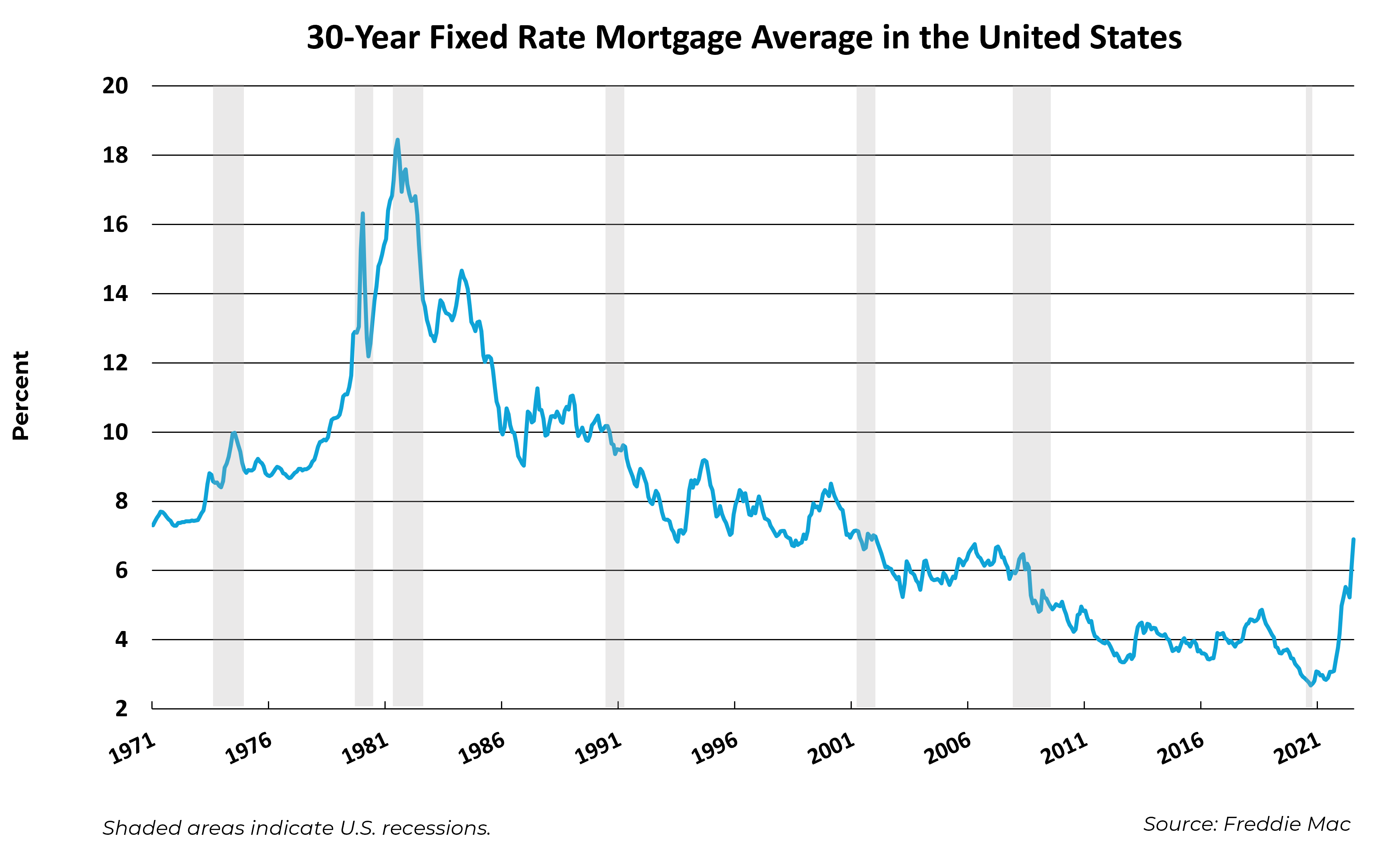

As for interest rates, yes – that have increased quite a bit – but it’s important to look at the bigger picture. Take a look at the graph below showing historical interest rates for 30-year fixed mortgages:

While interest rates were historically low in 2020 and 2021 at around 3%, that was an anomaly compared to rates from previous years. While we are currently seeing the highest rates we’ve seen in almost 15 years, we will start to see them come down to more normal levels as inflation starts to ease (which has already happened). A 5.5 or 6% interest rate is still very low compared to historical average annual rates since 1971.

The decreased competition also means more sellers are willing to negotiate concessions to get their homes sold. These concessions can be used to fund a seller-paid rate buydown that will allow you to realize a good amount of savings for the first couple years of your mortgage. If rates do drop (which we anticipate they will), you will have the opportunity to refinance to a permanently low rate.

Another thing to keep in mind when it comes to affordability is income. According to Payscale.com, the average annual salary increase in the United States is between 3 and 5 percent. While buying a home today may be a bit of a stretch on your finances, you will be able to count on your housing payment remaining the same while your wages continue to increase. If you continue renting, there is a chance a large portion of your pay increase will be eaten up by increased housing costs.

Finally, homeownership protects you from some of the impacts of inflation. Check out this article to learn how owning a home can shield you from the impacts of inflation.

The Bottom Line

Today’s housing market outlook is not as dire as the doomsday headlines would lead you to believe. The combination of adjusted housing prices, relatively low fixed interest rates, decreased competition, and rising rents makes now a very promising time to invest in real estate.