If you’ve been following our blog, you know we’ve written a lot of articles about why today’s housing market is vastly different from the one that preceded the 2008 housing crash.

Why? Because today’s housing market is vastly different from the one that preceded the 2008 housing crash!

Our mission at NEO is to help you build wealth and find financial freedom through smart mortgage and real estate planning. This starts with helping you understand what factors cause the housing market to fluctuate, so you can plan for the future and make a good investment that fits your lifestyle and financial goals.

When it comes to building wealth through homeownership, the main element is obviously price. The price of a home is determined by the same two forces that affect the price of all goods in any market: supply and demand.

The last few months of 2022 brought a dramatic shift to the housing market. Demand dropped significantly after interest rates skyrocketed, and this has resulted in more homes on the market and small price declines in some areas of the country.

Because this small correction is happening after several years of record-high home appreciation, many people are drawing comparisons to the 2008 housing crisis. And while there may be a few similarities, if you really look at the key variables that actually determine supply and demand in the housing market, you’ll see that there are several very important differences.

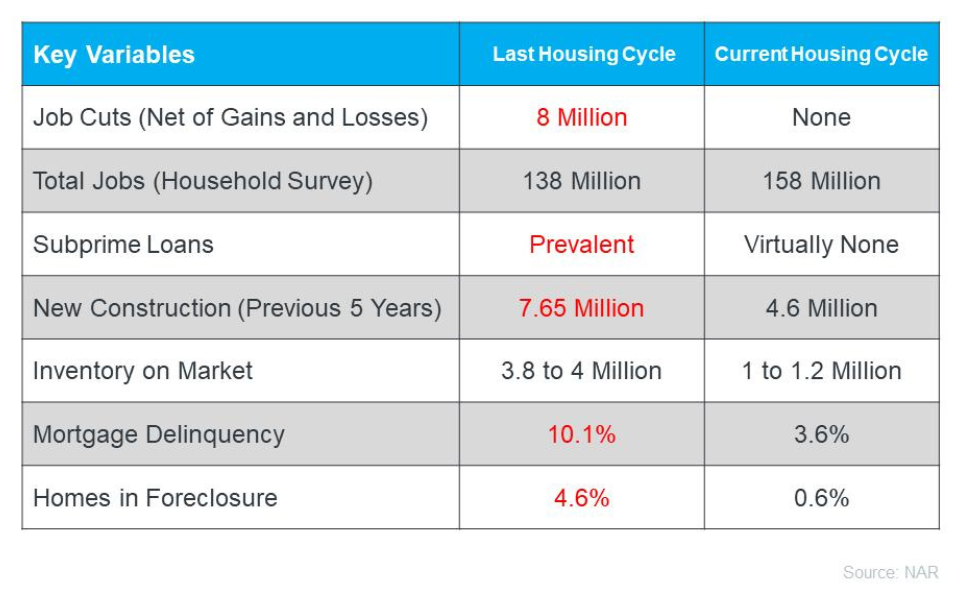

The data in the table below comes from NAR Chief Economist Lawrence Yun’s comments during the December 2022 Real Estate Forecast Summit.

Let’s start with jobs. There were 8 million job cuts in the years leading up to the housing crash – and there have been virtually none recently. The jobs market has been very steady, and today there are 20 million more jobs than there were 15 years ago. A healthy jobs market means stable and often increasing income for potential homeowners, leading to more demand for homes.

A big reason the housing market crashed in 2008 is because of the large amounts of subprime loans that were being made, or mortgages that were given to extremely unqualified borrowers. Mortgage underwriting standards are so strict now that these types of loans are virtually nonexistent. Nowadays, mortgages are only being made to those who have demonstrated ability to repay the loan. This means that homeowners today are very unlikely to default on their mortgages and add to the supply of homes on the market.

And healthy mortgages aren’t the only thing keeping home supply from rising. In the 5 years leading up to 2008, U.S. builders built 7.65 million new homes. This was in response to the “fake” demand for homes that the subprime mortgage market created.

Builders today have learned from that mistake. Only 4.6 million homes have been built in the U.S. in the last 5 years, which is why today we only have 1 to 1.2 million homes on the market – almost half of what was on the market leading up to 2008. What’s more, that “inventory” on the market includes homes that are already under contract to be purchased. In reality, the true number of homes that are available to impact the high demand is much less.

And finally, there are the foreclosures. Foreclosure activity has gone up since mortgage forbearance ended, but the foreclosure rate is still only at .6% – it was almost 8 times that amount in the years leading up to the 2008 crash.

The Bottom Line

The jobs market is stable and housing supply is very low. We are also in an environment where rents are increasing, people are still working from home, and more Americans than ever are entering their homebuying years. These factors are going to keep the housing market stable.

Have we seen a housing market correction? YES. But we believe the worst is already behind us. Interest rates are going down and demand is going up. If you are in the market to buy a home, now is the time to do it.