If you Google “recession” today, you’ll find thousands of differing opinions from reputable financial and economic news sources about what to expect in the economy.

Some believe that a recession is inevitable and bound to happen soon thanks to record-high inflation and the Federal Reserve raising interest rates to fight it. Others are of the mind that low unemployment numbers and high wages mean the economy will keep chugging along despite the higher prices and borrowing costs.

We agree with the first group. We believe that the current economic climate means a recession is certainly on the way if it is not already here. An while an economic downturn typically hurts the economy across the board, a mild recession could actually alleviate some of the pain Americans have been feeling in this historically expensive, competitive housing market.

Recession Signals Getting Louder

There are two main reasons why we believe a recession is imminent:

1. Consumers are running out of money

We have been heading toward a recession for quite some time, but it has been staved off because American consumers have not changed their spending habits even with prices rising.

The below graphs show how the amount of revolving consumer debt (first graph) and the personal savings rate (second graph) in America have changed over the last five years.

Credit card debt and other consumer debt dropped significantly during the first year of COVID thanks to 1) government stimulus that was used to pay down debt and 2) less discretionary spending because of lockdowns. But now that everything has returned to normal, consumer debt has skyrocketed to $1.5 billion higher than it was before the pandemic.

The personal savings rate has done the opposite. Americans were saving their stimulus and extra money in 2020 while they were stuck at home, but they have been tapping back into it significantly over the last two years.

The ability for people to use credit cards and spend their savings has an expiration date. Once those wells are tapped, Americans will stop spending, the economy will slow down, and we will be in a recession.

2. Inverted Yield Curve

Another way we can predict a recession is by looking at the difference between the 10-Year Treasury yield and the 3-Month Treasury yield.

Longer maturities, like the 10-Year Treasury, are supposed to have a higher rate of return than their short-term counterparts. However, there have been times in the past when the 3-Month Treasury Yield was higher than the 10-Year Treasury yield. An inverted yield curve is when the difference between the two drops into the negative.

The gray bars in the graph above show U.S. recessions. As you can see, every time the yield curve has inverted, a recession has immediately followed – and the yield curve is the most inverted it has ever been. We take this to mean a recession is at our doorstep.

Plummeting savings levels, government stimulus drying up, and the inverted yield curve are the most glaring indicators of a coming recession, but there are many other factors at play. Jay Voorhees from JVM Lending shared some of these in a recent blog post:

- Major problems overseas that will spill over to the U.S.

- Quickly tightening bank lending/credit standards that also predict recessions with surprising accuracy.

- The impact of tight monetary policy and the lag effects from higher rates that have NOT been felt yet, as many companies, investors and consumers are only now being forced to refinance into higher rates.

- Rising credit card delinquencies.

- The impact of student loan payments resuming.

- A pending commercial real estate crisis – due to high interest rates and very high vacancy rates.

Why a Recession Will Be Good for Housing

The impacts of recessions can be felt across the entire economy, everywhere from employment to spending to stock market movement, and even real estate. While the stock market and the housing market can fall during a recession, it isn’t guaranteed to happen.

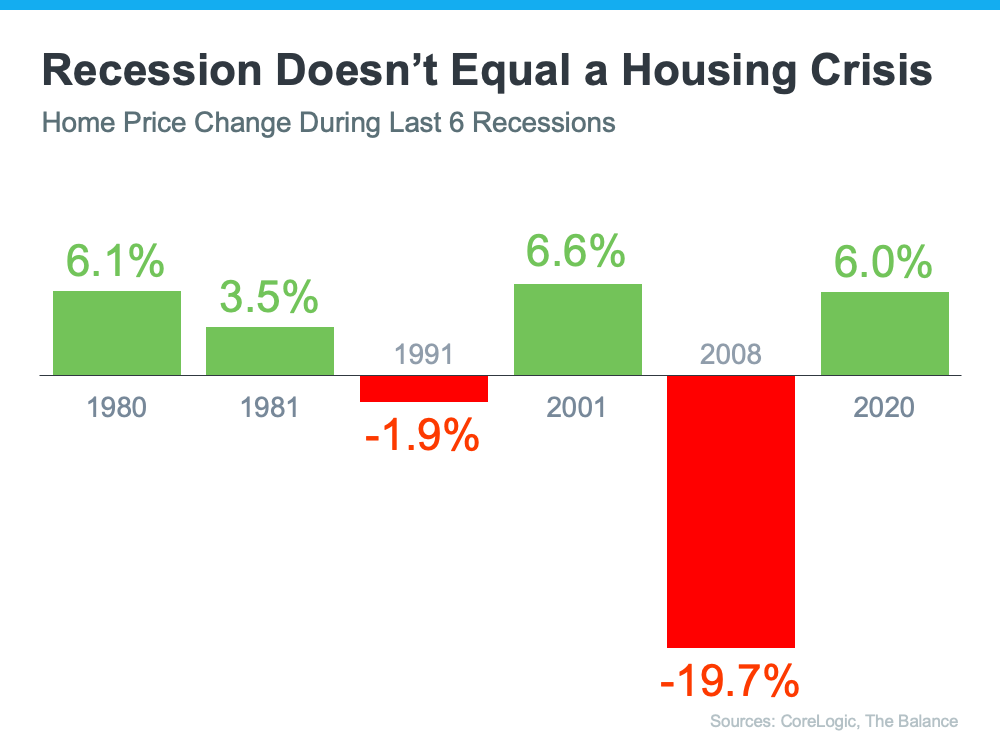

In fact, falling home prices are less common than you may think. Home values have remained steady or risen during the last five recessions, aside from the Great Recession and the recession of 1990.

During the recession in 1980, which is a similar recession to the one we are going through right now (high inflation, high interest rates, etc.), but home prices continued to rise at a good rate. Interest rates went up to 17% during this time, which is nothing like we are seeing now. The economy was very healthy back then, just like it is today.

The 1991 recession saw housing prices drop slightly for about a year.

In 2001, 9/11 created a big recession. That’s how interest rates went down and prices went up. After 9/11 occurred, our economic market completely shut down.

2008 was the only time we saw housing prices drop significantly, but that situation was very different. The decline in home prices actually caused this recession — not the other way around. Too much housing supply and not enough demand led to home prices tanking, and a recession followed.

Finally, in 2020, the Covid-19 pandemic brought on another recession. This one was so bad that the government started to print money. Housing prices started to creep up while everyone was sheltering in place, and they continued to rise nearly 16% over the whole year. In 2021, housing prices went up another 20%.

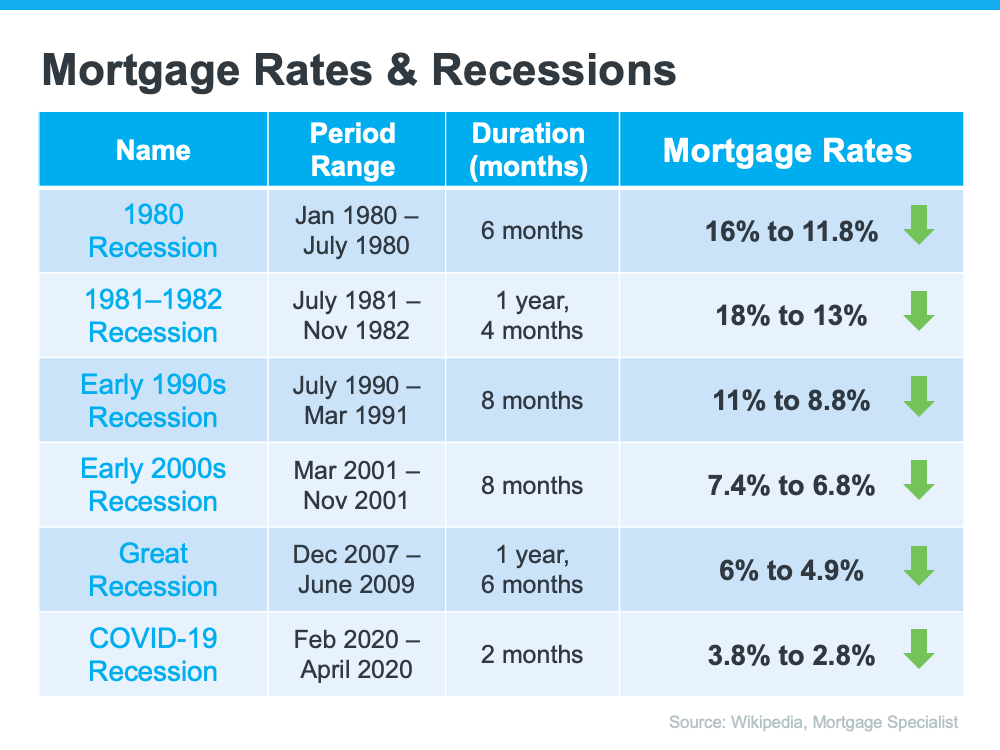

As for mortgage rates, they typically increase leading up to a recession, which is what we’re seeing today. But in order to come out of a recession, interest rates are lowered to stimulate the economy moving forward.

Here’s the data to back that up. Here’s what happened to mortgage rates in each recession going back to 1980:

As the chart shows, historically, each time the economy slowed down, mortgage rates decrease without fail.

The Bottom Line

While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

Will the housing market start to cool down as we enter a recession? Yes. This is only be expected as inflation and high interest rates make affording a home difficult for many Americans.

However, a slowing market does not mean a crashing one! Housing supply is still very low and demand is still very high. Until the supply problem is fixed, home prices will remain steady. Affordability constraints mean demand will dip slightly, but once we enter a recession and interest rates fall, demand will start to rise again.

Home prices are projected to appreciate for the next few years thanks to the overwhelming demand, meaning real estate will continue to be a safe and lucrative investment. If you would like help finding a home or getting pre-approved for a mortgage, fill out the form below to request a consultation with one of our mortgage advisors.